With all the hard work done for you

Be a part of every bottle sold in the U.S. and be a part of a solution to save the sea

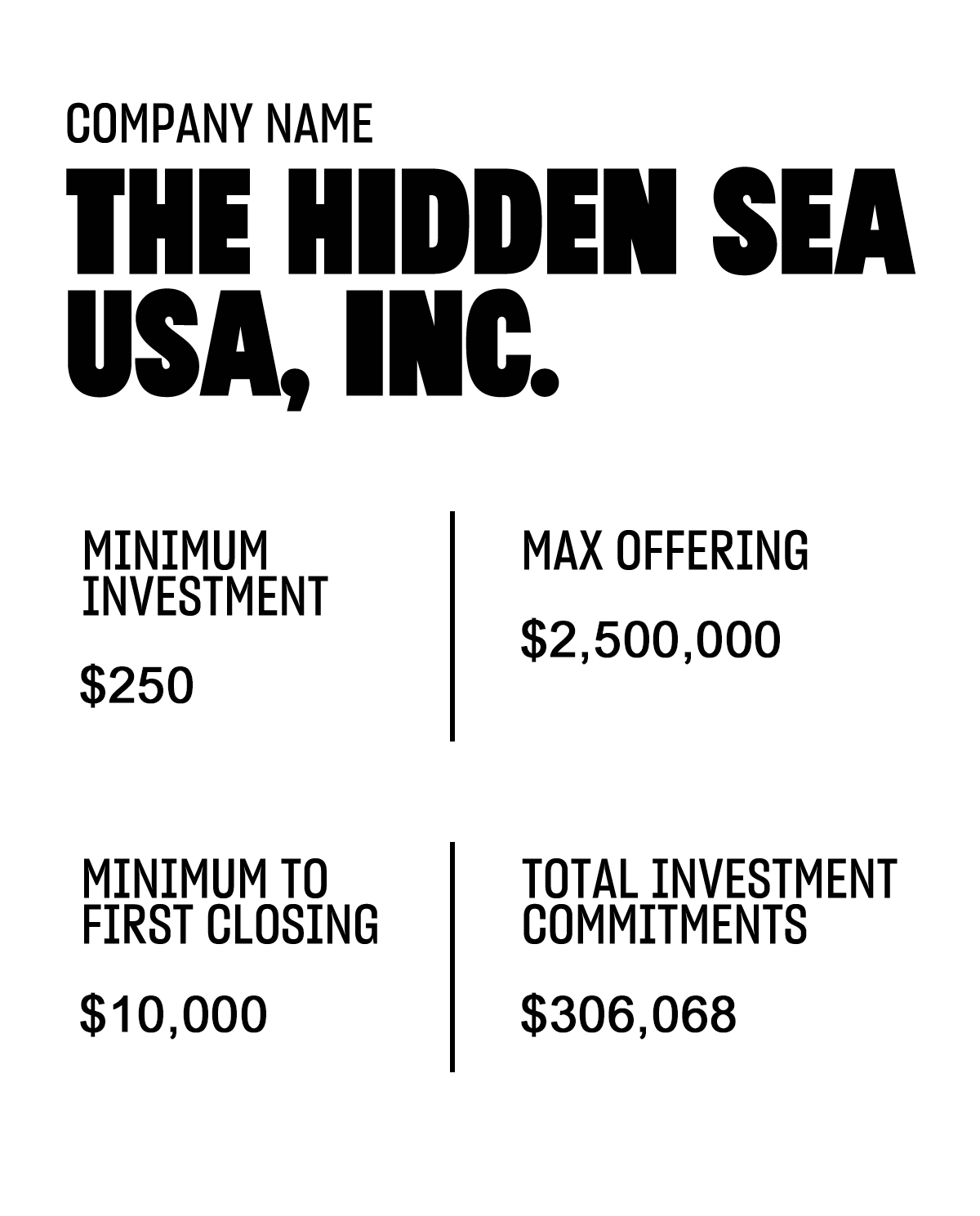

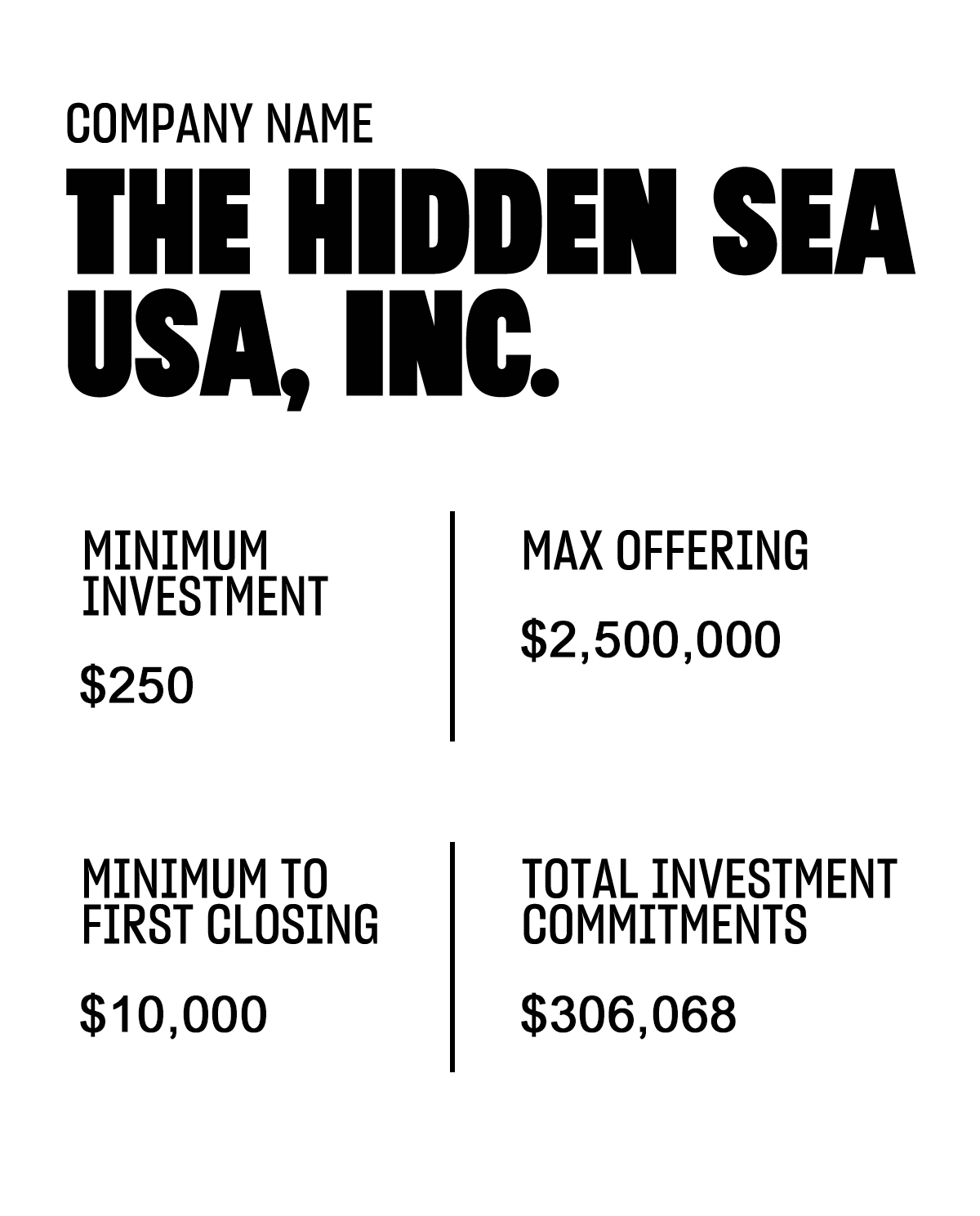

You get two bottles (and other PERKS) when you invest $250 or more in THE HIDDEN SEA USA

We have a goal to build a brand that’s an attractive acquisition target, and you can be a part of the journey. Here’s what that looked like with two other California-based brands:

• Meiomi Wines was acquired by Constellation Brands in 2015,

for $315 MILLION

• The Prisoner Wine Co. was acquired by Constellation Brands in 2019,

for approximately $285 MILLION

The Hidden Sea USA offers promising growth prospects as it expands from its base in California across the U.S., and this is YOUR CHANCE to participate in this opportunity. Your investment will contribute to this growth, and give you a piece of every wine bottle sold in the U.S. market (the biggest wine market in the world).

• The wine is ALREADY IN MORE THAN 600 U.S. LOCATIONS, including Kroger, Ralphs, Albertsons, Safeway, Smiths, Fred Meyer, and Amazon Fresh

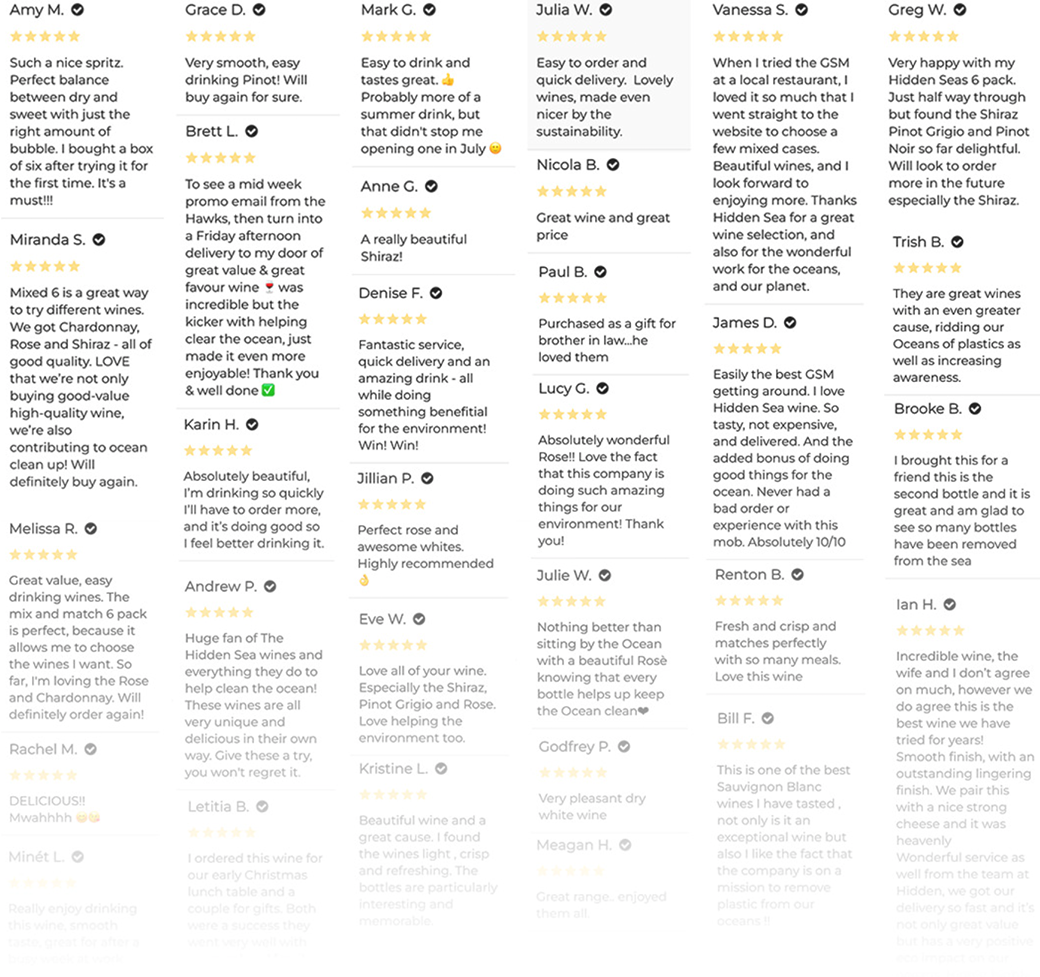

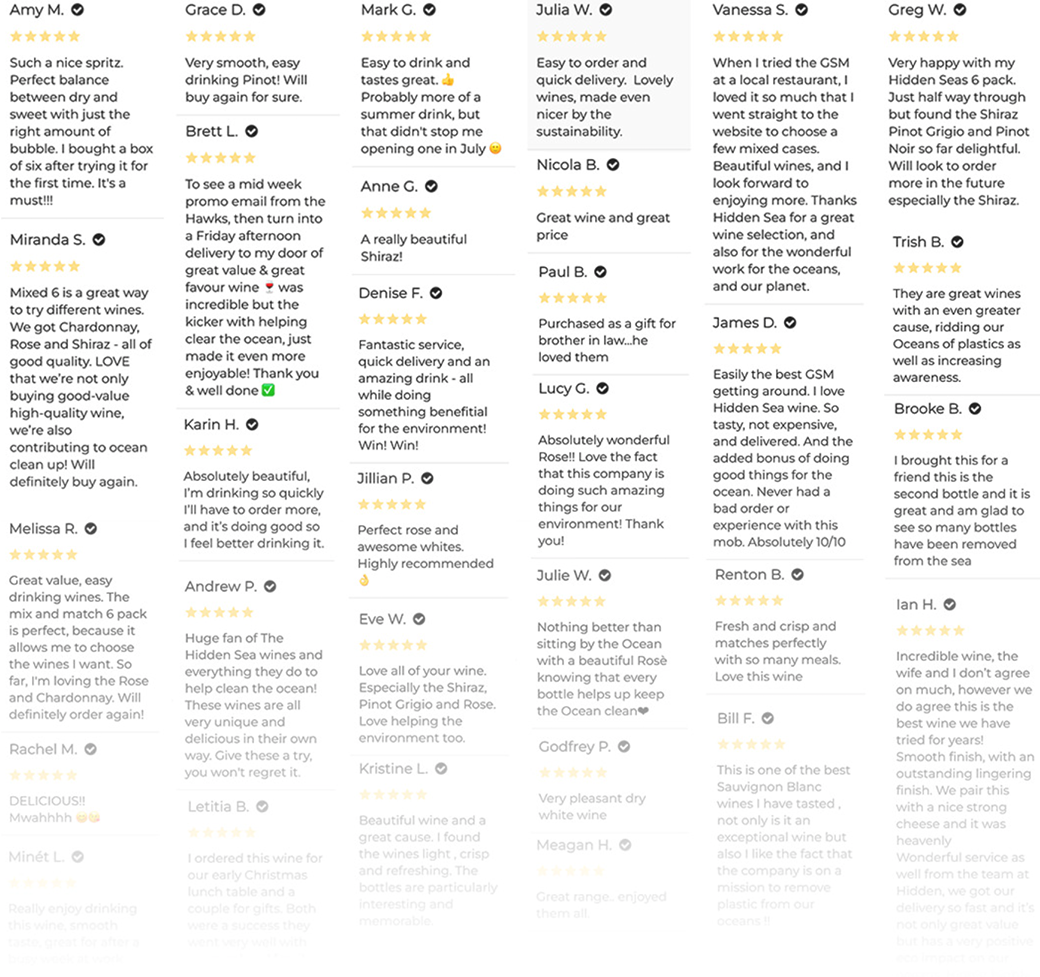

• Hundreds of 5-STAR REVIEWS and AWARDS from around the world

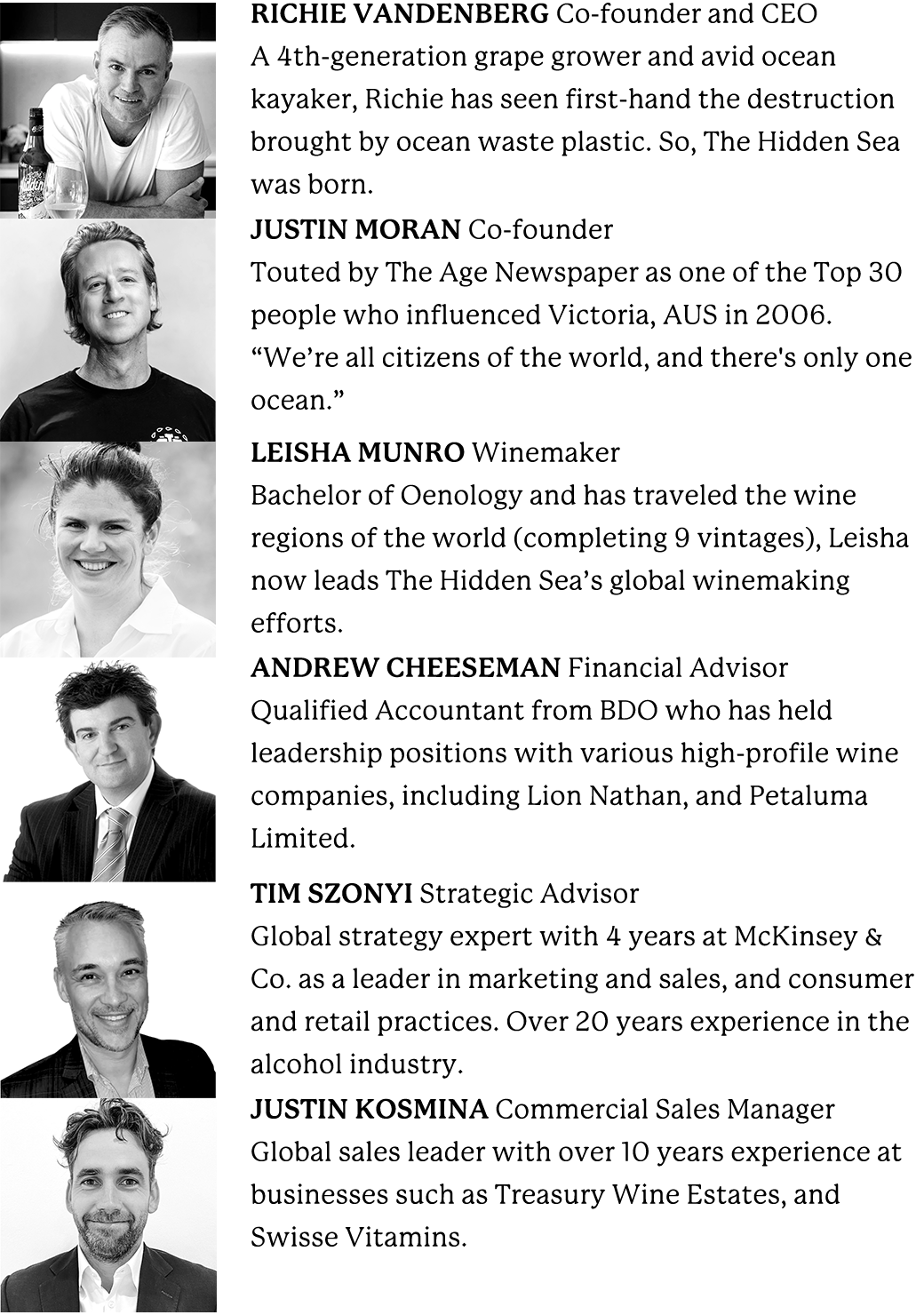

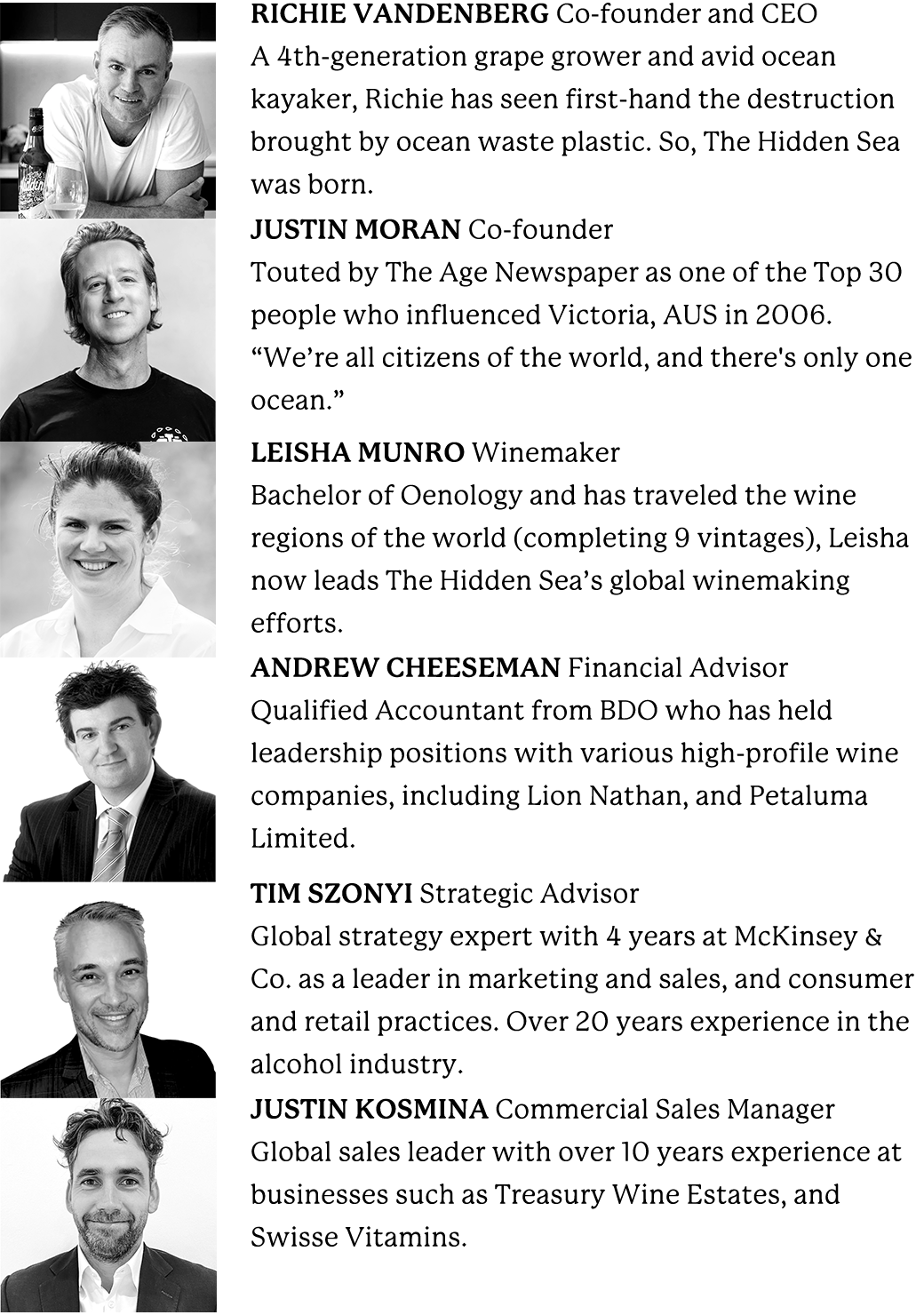

• A management team with over 60-YEARS COMBINED EXPERIENCE in the wine business

DISCLAIMER

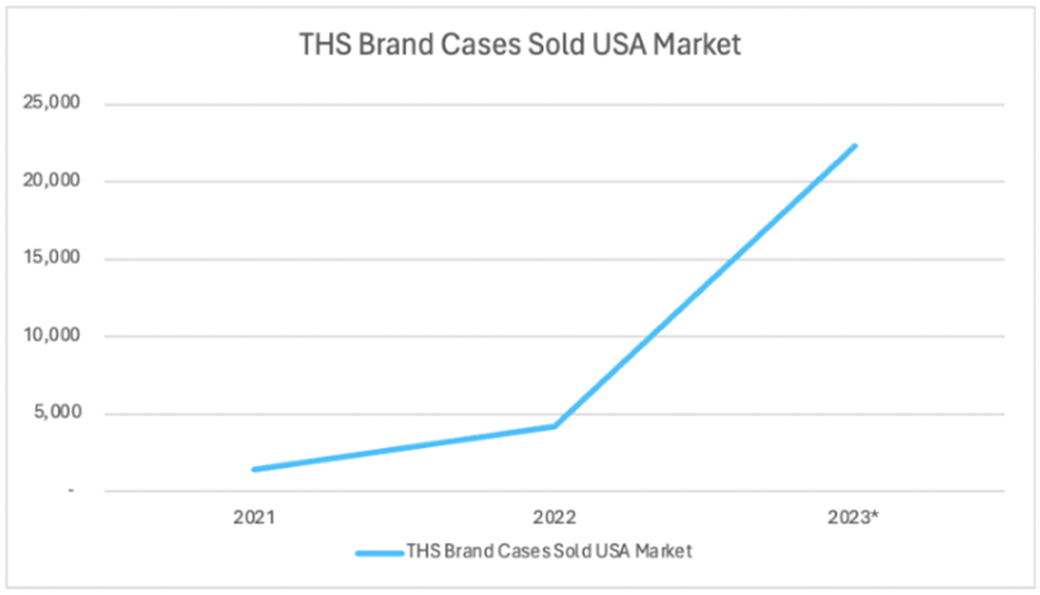

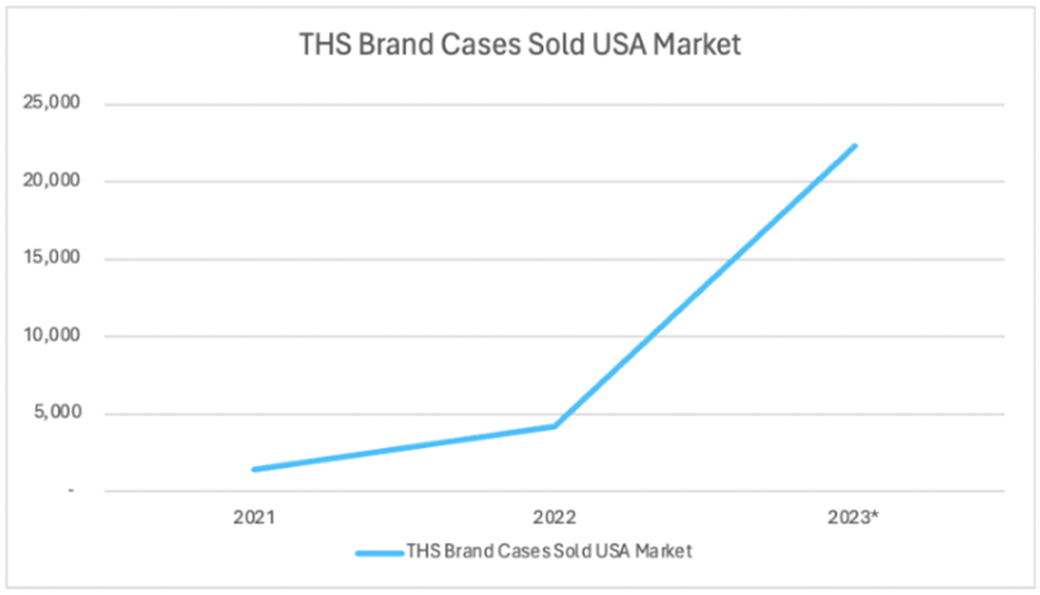

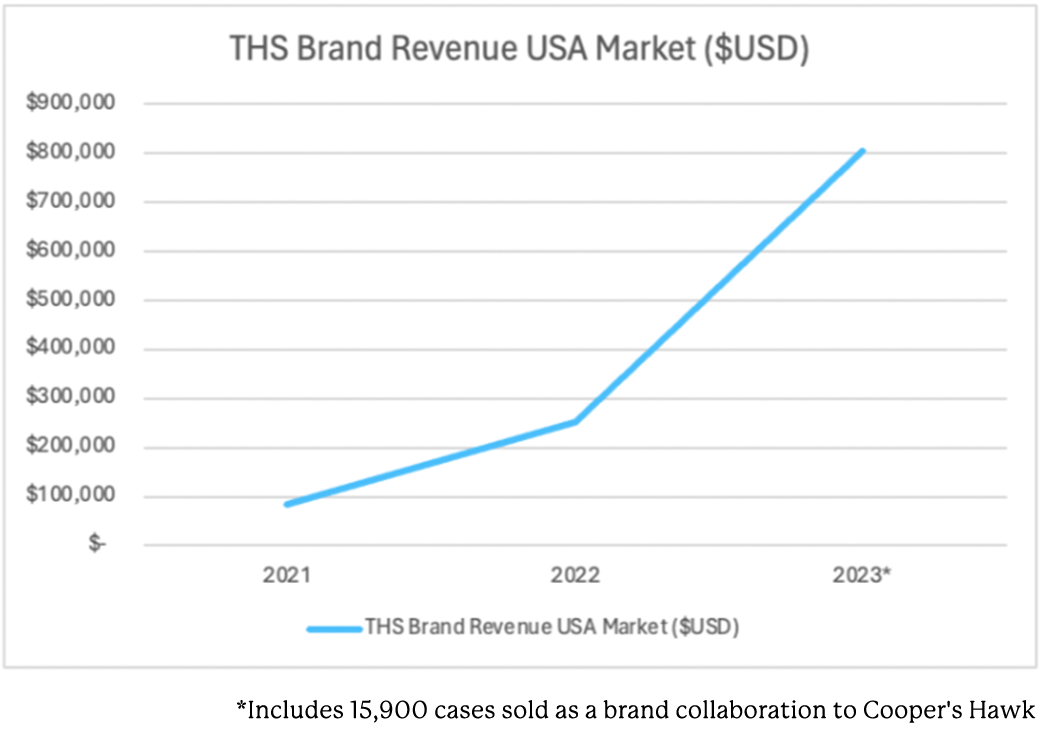

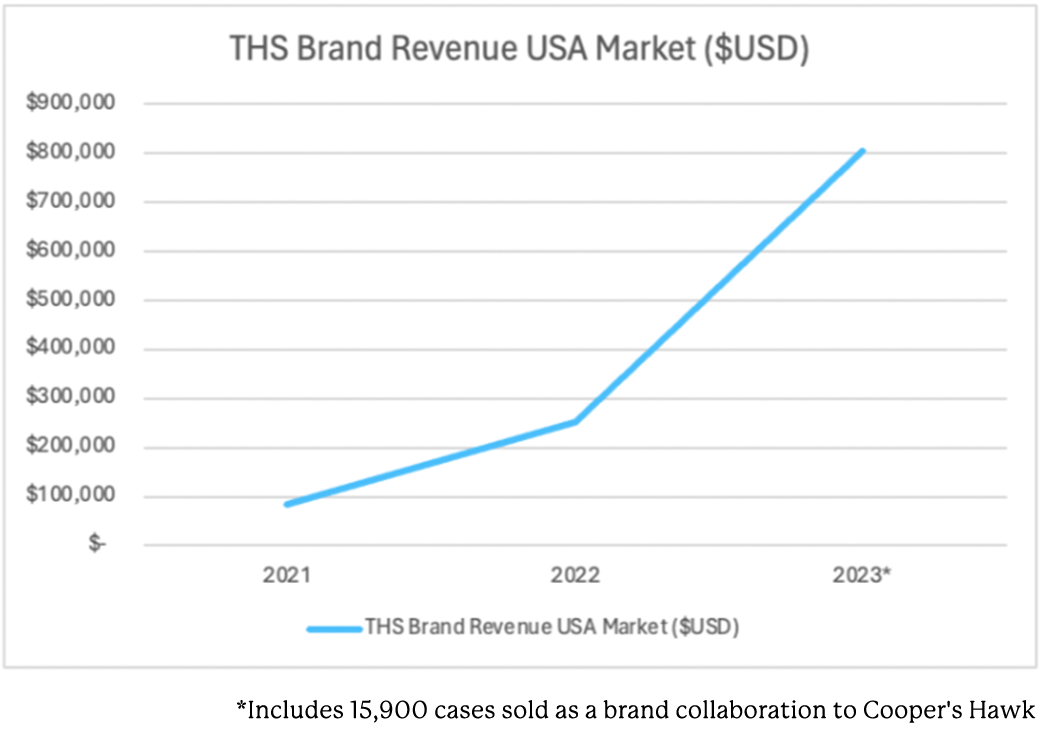

These charts represent U.S. sales made by our affiliated global company, and are not represented in the financials of The Hidden Sea USA, Inc. (which is taking over sales when the current U.S. stock is exhausted).

1. Maintain alignment between the brand, our importer (Precept), and our distributor partners in each state

2. Execute integrated sales and marketing plans to keep The Hidden Sea brand top-of-mind with the distributor sales teams

3. Build brand awareness through our mission, and by leveraging our brand ambassador network

hundreds of 5-star reviews

The more you invest in The Hidden Sea USA, the more shares you’ll own in the company. So, if the company increases in value, so do the value of your shares—but that’s not all!

We’re offering GREAT PERKS at a range of investment levels.

CEO, and Co-founder, RICHIE VANDENBERG moved his family to California to help grow the brand in the U.S. market. He’s a FOURTH-GENERATION GRAPE GROWER, and a retired AUSTRALIAN FOOTBALL LEAGUE (AFL) LEGEND.

AFL is the most popular sport in Australia, and Richie helped lead Hawthorn to become one of the winningest football clubs in the modern era. His leadership skills have grown The Hidden Sea global brand to 10 countries around the world, and now he’s focused on bringing his

PROVEN SUCCESS to The Hidden Sea USA, and its investors.

LEARN MORE IN THE VIDEO BELOW

The Hidden Sea vineyards in South Australia were once covered by the Southern Ocean, which created the nutrient-rich minerals that allow the grapes to flourish today.

The Hidden Sea honors this ocean heritage by REMOVING AND RECYCLING THE EQUIVALENT-IN-WEIGHT OF 10 PLASTIC BOTTLES from the ocean for every wine bottle sold.

DISCUSSION